This scheme will be available from 16th august 2014 to 14th august 2015.

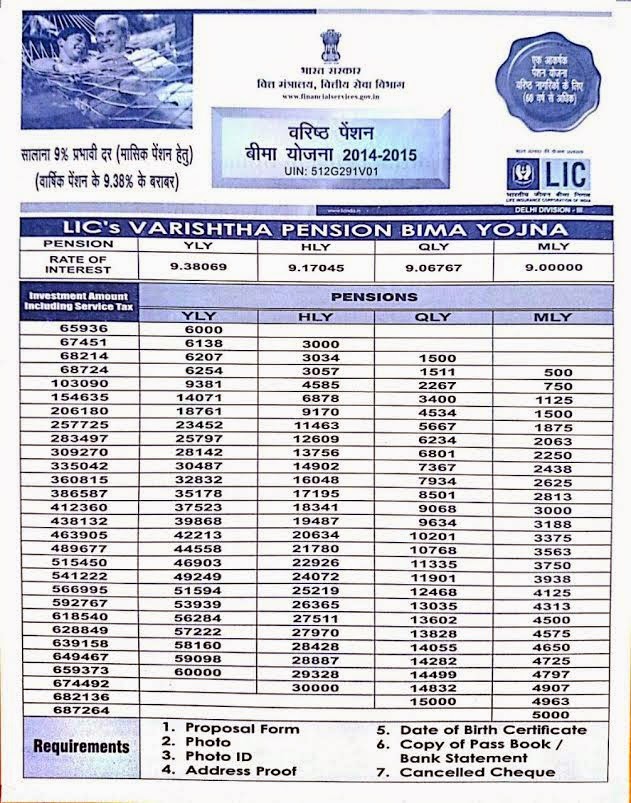

Lic Varishtha Pension Bima Yojana Table No 827 Chart including 3.09 % Tax

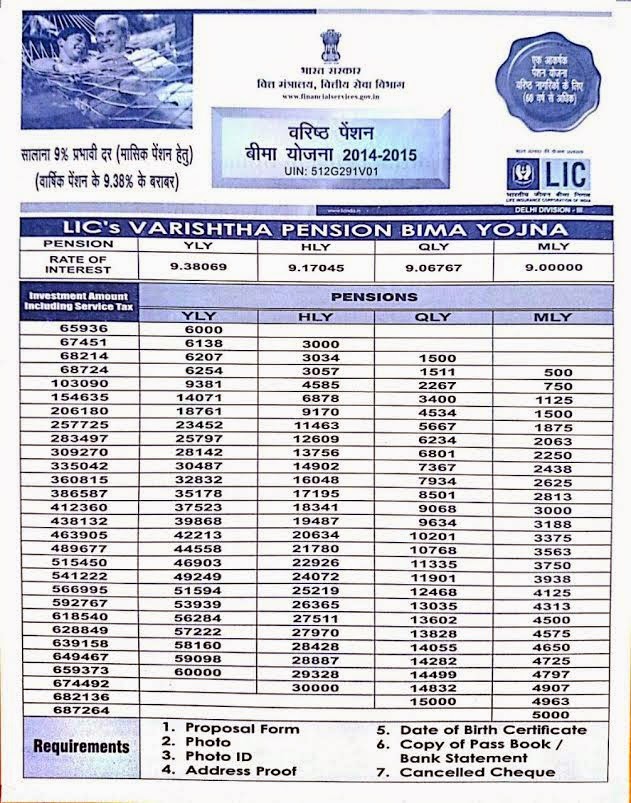

Lic Varishtha Pension Bima Yojana Table No 827 Form

Plan Details :

• Available to citizens aged 60 years and above. No maximum age limit.

• Pension would be on immediate annuity basis in monthly, quarterly, half-yearly or annual mode, varying, respectively, between Rs. 500 to 5000 (monthly), Rs. 1500 to 15,000 (quarterly), Rs. 3000 to Rs. 30,000 (half-yearly) and from Rs. 6,000 to Rs. 60,000 (annually), depending on the amount subscribed and the option exercised.

• The payout implies an assured return of 9% on monthly payment basis, which amounts to an annualized return of 9.38%.

• Loan (up to 75% of subscribed amount) can be availed after 3 years from the Date of Commencement. Present interest rate is 9% compounded half yearly.

• On death, the full purchase price will be refunded to nominee.

• Exit/surrender would be allowed after 15 years or earlier in special circumstances like critical / terminal illness of self or spouse.

• Payment will be through ECS or NEFT.

• Pension would be on immediate annuity basis in monthly, quarterly, half-yearly or annual mode, varying, respectively, between Rs. 500 to 5000 (monthly), Rs. 1500 to 15,000 (quarterly), Rs. 3000 to Rs. 30,000 (half-yearly) and from Rs. 6,000 to Rs. 60,000 (annually), depending on the amount subscribed and the option exercised.

• The payout implies an assured return of 9% on monthly payment basis, which amounts to an annualized return of 9.38%.

• Loan (up to 75% of subscribed amount) can be availed after 3 years from the Date of Commencement. Present interest rate is 9% compounded half yearly.

• On death, the full purchase price will be refunded to nominee.

• Exit/surrender would be allowed after 15 years or earlier in special circumstances like critical / terminal illness of self or spouse.

• Payment will be through ECS or NEFT.

Rebate:

No Rebate is available under this plan.

Taxes:

As per Tax laws, Taxes including service tax is applicable. Present year tax rate is 3.09 %. Policyholder has to pay the tax amount also while taking the policy. Tax amount which you pay on the purchase price is not considered for calculation of pension.

Surrender value:

The Varishtha Pension plan can be surrendered after 15 years. The surrender value payable is 100% Purchase Price means what we invested will be returned back if we want to withdraw after 15 years.

If any medical emergency exists for self or spouse then pension plan can be surrendered under exceptional circumstances, 98% of the purchase Price will be refunded back to the customer.

Pension Payable:

Pension in the form of Annuity is payable to the pensioner during the life time of the pensioner as per the mode (yearly, half yearly, quarterly, monthly) chosen by the pensioner.

Death Benefits:

If Death Occurs, Nominee gets invested amount.

Suicide clause: Not applicable

Locking period: 15 days. Policy Holder can return the policy if not satisfied with policy terms and conditions.

Assignments and Nominations: Possible

Lic Varishtha Pension Bima Yojana Table No 827 Chart including 3.09 % Tax

Lic Varishtha Pension Bima Yojana Table No 827 Form